|

|

|

|

|

Regulator's Draft Report Resumes Comparison Of Default Service & Retail Supplier Rates -- After Omitting Comparison Last Year When Retail Supplier Rates Were Cheaper

The following story is brought free of charge to readers by VertexOne, the exclusive EDI provider of EnergyChoiceMatters.com

A draft Connecticut PURA annual report to lawmakers concerning the state of electric competition is proposed to once again include a comparison of retail supplier rates and default service rates -- after omitting the customary data in last year's report

Last year's final report, covering the year 2023, did not include any listing or comparison of retail supplier rates versus standard service, though prior annual reports had included such comparisons. Last year's report went so far as to remove proposed language concerning price comparisons which PURA's Office of Education, Outreach, and Enforcement had drafted to include in the report, with such struck data showing that 99% of residential shopping customers paid a rate either lower than standard service, or which did not exceed standard service, during the first half of 2023

Last year, among other language, EOE's proposed report had included a statement that, "For the first half of 2023 customers in the Eversource territory receiving service from a supplier paid $81.42 less per month than if they received standard service, and in the UI territory customers receiving service from a supplier paid $57.54 less per month."

Such language was omitted from the final report covering the year 2023

Rather, the final report covering the year 2023 merely made note of where the monthly EDC price data is filed, and also made note of OCC's regularly issued price comparisons

A newly posted draft report covering the year 2024 now includes an entire section for, "Rates Paid By Customers Of Licensed Electric Suppliers"

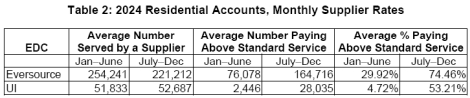

Among other things, the draft report covering the year 2024 would find that, "During the first half of 2024, residential customers were more likely to have a more favorable rate with a licensed electric supplier, but nearly 30% of Eversource residential accounts and 5% of UI residential accounts enrolled with a supplier paid more than the Standard Service rate for generation supply."

The draft report covering the year 2024 would further find, "The percentage of residential supplier customers paying more than Standard Service increased significantly in the second half of 2024 for Eversource customers, with approximately 75% of customers enrolled with suppliers paying more than Standard Service. The number of UI customers enrolled with a supplier and paying more than Standard Service also increased significantly, with over 53% of UI’s supplier-enrolled residential customers paying more than Standard Service."

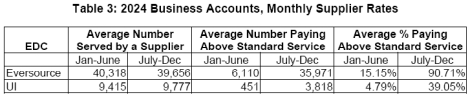

The draft report covering the year 2024 includes the following tables comparing supplier and default service rates, for both residential and small business customers.

Notably, the draft report finds that 90% of shopping business customers at CL&P who are under 500 kW paid more than standard service in the second half of 2024 (standard service is only available to customers under 500 kW; default service for large customers is known as Last Resort Service)

The report notes the aggregate savings enjoyed by residential shoppers during the first half of 2024, using June as an example

In June 2024, approximately 76% of Eversource residential customers who were served by a retail supplier paid a price at or below the standard service rate of 14.714¢/kWh, with aggregate savings of nearly $4,000,000 to those customers, based on such customers' consumption. For those CL&P shopping residential customers paying more than standard service in June 2024, those customers in aggregate paid over $600,000 more than they would have paid on the standard service rate, based on such customers' consumption

Approximately 97% of UI residential customers who were served by a supplier paid a rate at or below the standard service rate of 17.0625¢/kWh in June 2024, resulting in savings to these customers of $1,670,125. For June 2024, UI residential shoppers who paid a supplier rate higher than standard service paid $14,435 more than they would have paid under standard service.

The draft report covering 2024 notes that, for the second half of 2024, "many" Eversource residential shoppers paid "significantly" more than the standard service rate for their electric supply, "with some paying 22.99 cents per kWh, nearly three times the standard service rate."

"In December 2024, as has typically been true, the modest savings by Eversource residential customers with rates below the standard service rates (less than $100,000) were dwarfed by the extra cost borne by customers with rates above the standard service rates (a net loss of over $5,000,000)," the draft states

At UI, for December 2024, the draft finds that the savings for residential shopping customers who paid rates below the standard service rate were nearly matched by the extra cost borne by shopping customers who paid rates above the standard service rate (net loss of less than $1,000).

However, even while the aggregate net impact considering shopping as a whole was de minimis, a group of UI residential shoppers paid more than $300,000 over the standard service rate in December 2024, the draft states

The draft report does note that, "Some customers paying slightly more than the standard service rate for the end of 2024 may be on a long-term supplier contract anticipated to result in savings in the first half of 2025."

The draft notes that customer complaints against retail suppliers fell to 38 in 2024, down 60% from 95 in 2023, and down from 204 in 2020

The draft states, "Calendar year 2024 saw supplier complaints decrease by 60% compared to 2023. This significant decrease may indicate that the Authority’s close oversight of the Connecticut market is increasing suppliers’ compliance and improving customers’ experiences in the Connecticut market. In addition, residential customers may be more aware of their cancellation rights. Raising residential customers’ awareness of the need to monitor the Supply Summary section on their bill remains an ongoing effort by EOE."

Docket 24-11-01

Copyright 2025 EnergyChoiceMatters.com. Unauthorized copying, retransmission, or republication

prohibited. You are not permitted to copy any work or text of EnergyChoiceMatters.com without the separate and express written consent of EnergyChoiceMatters.com

75% Of Residential Shoppers -- & 90% Of Small C&I (!) Shoppers -- Paid More Than Default Service In 2H 2024

Complaints Against Retail Suppliers Fall To Only 38 For Entire Year

March 21, 2025

Email This Story

Copyright 2025 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

|

|

|

|

|