|

|

|

|

|

Update 2: The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

This is a breaking story. The report will be discussed further at today's open meeting. Check back and refresh this story for updates

Update 2, 3:15 pm ET

During discussion of the PCM, Chairman Peter Lake, describing the PCM in broad strokes, said that the PCM would require sellers of power to customers (REPs) to "guarantee" that such power is, "from a reliable source"

As noted in our earlier story below, this would be accomplished through an allocation of PC costs among LSEs based on their pro-rata shares of system demand across the same highest risk hours. Lake described this as a "residual" process

Lake noted that, as noted in our original story, LSEs would have the option to procure on a forward basis, but there would be no requirement to do so.

Specifically, as previously reported, there would be a voluntary centrally-cleared forward PC market, described by the report as follows: "ERCOT administers a voluntary centrally-cleared forward auction for PCs based on bids to buy PCs from LSEs (demand curve) and offers to sell PCs from generators (supply curve). While the forward market is voluntary, participation in the forward market is a prerequisite for generators to be eligible to produce PCs; however, actual quantities of PCs produced may differ from forward offers – thus it is not expected that this mandatory forward offer requirement would have any impact on the ultimate quantity of PCs that are awarded or on the settlement price. LSE participation in the ERCOT PC market is entirely voluntary."

Lake said that, "based on what I know today," PCM is the best mechanism to fulfill SB 3's mandate for reliability

However, Lake said that the PUC needs to hear from stakeholders and the general public

The PUC opened a new project for the report and invited public comment on specific questions

All Commissioners stressed that, while expressing their views based on current information, none had made a final decision and each will consider the public comment

Commissioner Will McAdams said that PCM is distinguishable from the forward capacity markets in other ISOs, since there is no mandatory forward obligation

While McAdams did not explicitly support the PCM in so many words, his comments were generally complimentary towards it.

Commissioner Lori Cobos generally expressed concern with cost impacts of the proposals, and the forecasts that were used in cost impact estimates

Cobos said that a backstop reliability solution should still remain under consideration during the time needed to implement the PCM.

Cobos also said that more non-spin is not an appropriate bridging solution at this time, citing concerns by the IMM related to alleged non-competitive behavior, which will be addressed in an IMM report

Lake agreed that the non-spin concerns should be addressed as quickly as possible

Commissioner Kathleen Jackson supported moving forward with consideration of a PCM and welcomed public comment

Commissioner Jimmy Glotfelty said that his preference as of today is a backstop reliability mechanism paired with the Dispatchable Energy Credit (DEC) proposal, but said that he awaits public comment to further consider the PCM. Glotfelty suggested an expanded DEC -- not expansion into a full capacity market, but into additional attributes. Glotfelty sought public comment on impacts from an expanded eligibility (and quantities procured) for DEC

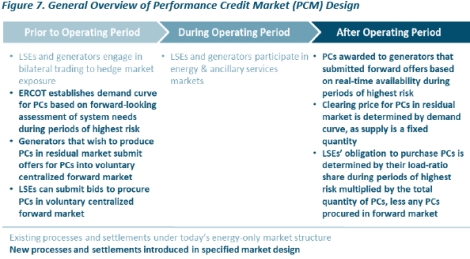

See a summary of the PCM in the table below

Update 1, 11:21 am:

Staff, in its memo, addresses the principle that the chosen market design, "be compatible with ERCOT’s competitive retail electricity market."

Staff states that the Performance Credit Mechanism [PCM] design fulfills this principle, with Staff offering its view that the PCM is compatible by:

"• Building a transparent, centralized PC market run by ERCOT provides LSEs the ability to voluntarily purchase credits ahead of the actual allocation."

"• Allowing LSEs to hedge against an ex-post allocation by purchasing PCs in the voluntary forward PC market supports competition."

Original story:

10:50 am ET

Texas PUC Staff have filed a report from a consultant for the Texas PUC which makes recommendations on Phase II market design for ERCOT

The consultant recommends that ERCOT implement a Forward Reliability Market (FRM) market design.

However, in a memo, PUC Staff says that a novel Performance Credit Mechanism [PCM] design fulfills the requirements of Senate Bill 3 to meet the reliability needs of the ERCOT power region while also accomplishing the principles of a load-side reliability mechanism

The consultant does not favor the PCM due to its novelty

The Forward Reliability Market (FRM) establishes a centrally-cleared auction for the forward procurement of reliability credits. Reliability credit requirements for each LSE and their corresponding share of costs are determined at the end of the compliance period based on their actual share of system load during periods of highest reliability risk. "In this construct, load reductions during critical hours allow LSEs to reduce their reliability requirements, providing an economic signal for demand-side resources to compete with supply-side resources," the report states

Under the FRM, under a centralized procurement framework, ERCOT would hold a centralized auction for reliability credits. Demand for credits would be based on an administratively determined demand curve, designed to procure sufficient reliability resources to meet the target reliability standard. The supply curve would be comprised of generator offers and would be tied to the additional revenue generators require to either enter the market or not exit the market. Procurement quantity and price would be determined where supply and demand intersect, and all generators that clear would receive the market clearing price, determined by the bid of the marginal generator

As stated in the report, key attributes of the FRM design include:

• "Forward-looking assessment of system need: ERCOT conducts a forward-looking assessment of the resources needed to achieve a designated reliability standard, e.g., “one day in ten years” (LOLE of 0.1 days per year)."

• "Resource accreditation: reliability credits are assigned to each resource in a technology-agnostic manner using a marginal effective load carrying approach (ELCC) approach. ELCC is specific methodological approach to measuring a resource’s effective capacity. Marginal ELCC reflects each unit’s capability to deliver energy to the system during the anticipated periods of highest reliability risk, measured as the hours of lowest incremental available operating reserves. These hours are typically, but not exclusively, aligned with peak net load. It is an important feature of this design that the total reliability requirement (the forward-looking assessment) and resource accreditation are measured on the same ELCC basis.

• "Sloped demand curve: ERCOT would develop an administratively-determine sloped demand curve that was set at a level to yield target reliability, to provide for price stability, and to send a signal to the market when excess supply (relative to the reliability requirement) was becoming low."

• "Centrally-cleared forward market for reliability credits: ERCOT holds an auction to procure reliability credits from generators to meet total needs. The auction would be conducted on a prompt basis, immediately before the start of the compliance period."

• "Allocation of costs to individual LSEs: the cost of the centralized auction would be retrospectively allocated among LSEs based on their share of system load during the hours of highest reliability risk (e.g., top 30 hours of lowest incremental available operating reserves). This ensures that LSE costs both reflect any potential load migration that occurs after the prompt auction and fully compensates actual realized demand response."

• "Generator penalties and incentives for real-time performance: Resources that sell reliability credits incur an obligation to perform during the hours of highest reliability risk and are assessed based on their performance during these hours. If resources that were paid for reliability credits fail to perform during the assessed hours, ERCOT would apply a financial penalty. The quantitative analysis in this study assumes that resources perform at levels consistent their accreditation, and properly structured incentives are necessary to achieve this – a topic discussed in more detail in Section 8 Additional Considerations and Implementation Options. This design component ensures resources will not seek accreditation higher than their actual expected capabilities if they will be held financially accountable to perform at those levels."

The report also discusses a novel Performance Credit Mechanism not previously offered for consideration.

As described in the report, "The Performance Credit Mechanism (PCM) establishes a requirement for LSEs to purchase “performance credits” (PCs) – earned by generators based on their availability to the system during the hours of highest risk – at a centrally determined clearing price."

"The PC requirement is a fixed quantity that is determined

in advance of the compliance period, while the settlement process occurs retroactively based on the quantity of PCs that were actually produced. PCs are awarded to generators after the close of the compliance period based on a look-back of their availability across a predetermined number of hours of highest reliability risk (e.g., top 30 hours) measured as the hours of lowest incremental available operating reserves. These hours are typically, but not exclusively, aligned with peak net load. When those hours occur is determined retrospectively based on actual system conditions (similar to the hours that determine 4CP). Each LSE’s obligation to purchase PCs is based on its pro-rata share of system load during those same hours, and the clearing price of PCs is determined based on an administratively-determined demand curve designed to achieve a target reliability standard (like other designs, an LOLE standard of 0.1 days per year is assumed). In addition to this retroactive settlement process, ERCOT also administers a centrally cleared voluntary forward market for LSEs and generators to exchange PCs to hedge against potential adverse outcomes in the retroactive settlement process; while this forward market is voluntary, generators must participate in the forward market in order to qualify to participate in the retroactive PC settlement process," the report states

The report states key attributes of the PCM design include:

• "Forward-looking requirement assessment: ERCOT determines the aggregate availability of resources during the anticipated hours of highest reliability risk (predetermined number of hours, e.g., 30 hours) for a system that meets the 0.1 days/year LOLE reliability standard. This value is represented as an annual MWh number that represents the cumulative availability of all resources across the hours of highest reliability risk."

• "Sloped demand curve for retroactive settlement process: The price to procure PCs is based on an administratively-determined demand curve developed by ERCOT that is designed to yield revenues of net-CONE per unit of effective capacity for a system at target reliability. The slope of the demand curve is designed to mitigate annual PC price volatility, recognizing that any given year may produce slightly more or fewer PCs than forecasted. The PCM demand curve would need to be adjusted every year."

• "Mandatory retroactive settlement process: After the operating year, PCs are awarded to generators based on a lookback at their availability across the highest risk hours (e.g., 30 hours) of the period; one credit is awarded for each hour in which a megawatt of capacity was offered into the energy or ancillary services market. The price for PCs is settled by cross-referencing the total quantity of PCs awarded with the demand curve. The total cost of PCs (total PCs awarded times the settlement price) is allocated among LSEs based on their pro-rata shares of system demand across the same highest risk hours."

• "Voluntary centrally-cleared forward PC market: ERCOT administers a voluntary centrally-cleared forward auction for PCs based on bids to buy PCs from LSEs (demand curve) and offers to sell PCs from generators (supply curve). While the forward market is voluntary, participation in the forward market is a prerequisite for generators to be eligible to produce PCs; however, actual quantities of PCs produced may differ from forward offers – thus it is not expected that this mandatory forward offer requirement would have any impact on the ultimate quantity of PCs that are awarded or on the settlement price. LSE participation in the ERCOT PC market is entirely voluntary."

The report states that this PCM design is deliberately structured to achieve the same reliability outcomes as the LSERO [Load Serving Entity Reliability Obligation] and FRM [Forward Reliability Market]; the key difference is that the LSERO and FRM designs accredit generators ex-ante based on their expected contributions to the system during peak net load periods (with penalties/rewards for deviations from this accreditation), whereas the PC design awards performance credits to generators retrospectively based on actual availability during hours of highest reliability risk.

While all three designs require LSEs to procure credits based on generation availability during hours of highest reliability risk (typically peak net load), the report states there are key differences:

• "In the FRM and LSERO, generators receive an ex-ante accreditation based on their expected contributions to the system during peak net load periods (and are penalized/rewarded for deviations from this accreditation), whereas the PCM awards credits to generators retrospectively based on actual availability during peak net load periods.

• "The FRM and LSERO markets clear and establish prices before the operating period (and thus are invariant to actual system conditions during the year) whereas in the PCM the settlement of PCs occurs retrospectively and is and thus dependent on actual system conditions.

• "The PCM design necessarily clears in a centralized manner with a sloped demand curve in order to avoid price formation that would clear at $0/MWh for any system with PC production that exceeds the target or a price at a regulated price cap for any system with PC production that does not meet the target. The FRM features a similar sloped demand curve in the forward auction that modulates the price and quantity of reliability credits procured based on scarcity. The LSERO is entirely bilateral and therefore has no administratively determined demand curve."

See the report here

ADVERTISEMENT ADVERTISEMENT Copyright 2010-22 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Texas PUC Chair: PCM Requires Retail Providers To "Guarantee" Power Sold To Customers Is "From A Reliable Source"

With PUC Seeking Public Comment, Commission Not Currently Unanimous On PCM Proposal

Chair: Concerns About Existing Non-competitive Behavior In Non-Spin Should Be Addressed As Quickly As Possible

Update 1:

Breaking: Texas PUC Staff Says Novel Centrally Cleared Performance Credit Mechanism Would Meet Statutory Reliability Objectives

Consultant For Texas PUC Recommends Different Forward Reliability Market With Centrally Cleared Auction

Both Proposals Use Administratively Determined Demand Curve

November 10, 2022

Email This Story

Copyright 2010-21 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Pricing Manager -- Retail Supplier

• NEW! -- Pricing and Operations Analyst

-- Retail Supplier

• NEW! -- Sales Director

• NEW! -- Market Operations Analyst -- Retail Supplier

• NEW! -- Accounting Manager -- Retail Supplier

• NEW! -- Sales Development Representative

• NEW! -- Operations Analyst/Manager - Retail Supplier

• NEW! -- Customer Success

• NEW! -- Operations Manager - Retail Supplier

• NEW! -- Marketing Associate - Retail Supplier

• NEW! -- Supervisor-Commercial Operations

• NEW! -- Market Operations Analyst

• NEW! -- Customer Data Specialist

• NEW! -- Director, Regulatory Affairs, Retail Supplier

• NEW! -- Account Manager Project Manager

• NEW! -- Retail Energy Policy Analyst

• NEW! -- Incentive Specialists

• NEW! -- Utility Rates Specialist

• NEW! -- Customer Onboarding Specialist

• NEW! -- Energy Performance Engineer

|

|

|

|