|

|

|

|

|

PJM Provides Further Update On Disposition Of Portfolio Of Energy Marketer Which Had Defaulted; Discusses Whether Default Allocation Cost Is Or Is Not Likely

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

PJM issued a new market notice providing a further update on the disposition of the portfolio of Hill Energy Resource & Services, LLC, which defaulted at PJM in January, as previously reported

PJM said in the notice that, in the April FTR Auction that was cleared and posted today, PJM was able to liquidate all of the remaining defaulted Hill portfolio FTR positions effective from April 1, 2022, through May 31, 2022.

The net proceeds of liquidating these positions were $0.81 million.

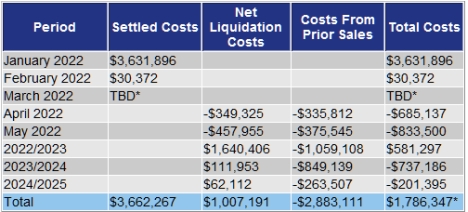

When added to the settled losses on the Hill portfolio of $3.66 million through February, and considering the net cost of liquidating defaulted Hill Long-Term FTR positions of $1.81 million and the $2.88 million in proceeds from previously sold positions, the total loss thus far on the Hill portfolio is $1.79 million.

The chart below details the resolution of Hill positions and liabilities to date:

Notes:

• March Settlement still to be determined.

• Negative costs represent profits that reduce total costs.

• Total costs do not include recovery of PJM’s Administrative Costs. Through 2025, those are estimated at $150,000.

PJM is holding $6.1 million in collateral with which to cover this loss. PJM said in the notice that, as a reminder, the March 2022 positions will go to settlement.

PJM said that, after the March 2022 defaulted Hill FTR positions go to settlement, and as a result of the successful liquidation process for all future defaulted Hill FTR positions, there will be zero outstanding defaulted Hill FTR positions. PJM will provide a final update after the March 2022 positions are settled, "but at this time we do not expect there to be any default allocation cost to the PJM membership as a result of the defaulted Hill FTR portfolio," PJM said

ADVERTISEMENT Copyright 2010-21 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

March 24, 2022

Email This Story

Copyright 2010-21 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Operations Billing Analyst

- Retail Energy

• NEW! -- Head of Operations -- Retail Supplier

• NEW! -- Head of Digital -- Retail Supplier

• NEW! -- Senior Energy Pricing Lead - Retail Energy

• NEW! -- Business Development Manager - ERCOT -- Retail Supplier

• NEW! -- Sales Development Rep

• NEW! -- Structuring Senior Analyst -- Retail Supplier

• NEW! -- National Key Accounts Sales Manager -- Retail Supplier

• NEW! -- Sales Director -- Retail Supplier

• NEW! -- Power Supply Analyst II -- Retail Supplier

• NEW! -- Business Development Manager -- Retail Supplier

• NEW! -- Technical Sales Advisor -- Retail Supplier

• NEW! -- Sales Support Analyst II -- Retail Supplier

• NEW! -- Software Developer -- Retail Supplier

• NEW! -- Gas Scheduler II -- Retail Supplier

• NEW! -- C# Developer -- Retail Supplier

• NEW! -- IT/OT Asset Manager -- Retail Supplier

• NEW! -- Business Development Manager III -- Retail Supplier

• NEW! -- Energy Markets Pricing Analyst

• Energy Pricing Analyst -- Retail Supplier

• Digital Marketing Manager -- Energy Marketer

|

|

|

|