|

|

|

|

|

New Jersey Releases 2021 BGS Auction Prices; First Auction Which Removes Transmission Charges From Auction Price

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

The New Jersey Board of Public Utilities (NJBPU) has approved the 2021 procurement of contracts for one-third of the fixed price Basic Generation Service (BGS) default electric service

The February 2021 auction was the first auction conducted since a result of a November 2020 Board decision under which the EDCs are now required to remove the transmission component of the BGS product for existing and future BGS contracts (with the EDCs assuming responsibility for transmission charges, rather than the wholesale BGS supplier). For BGS customers, transmission charges, which remain bypassable and part of the price to compare, will be passed through by the EDCs.

In such November decision, the BPU rejected a proposal from retail suppliers to similarly relieve retail electric suppliers from responsibility for transmission charges, as suppliers proposed that such responsibility also be moved to the EDCs (with transmission charges collected by EDCs on a nonbypassable basis)

Removing transmission as a component for which BGS suppliers are responsible is the primary driver for the observed decline in winning Residential and Small Commercial Pricing (RSCP) auction prices for all four EDCs in the 2021 auction, with declines of between 10.6 percent and 36.6 percent compared to last year’s auction. Due to the change in BGS product, an apples-to-apples comparison to prior auction rates is not possible, and the decline in the BGS auction prices does not necessarily mean overall prices to compare will decline by a comparable amount.

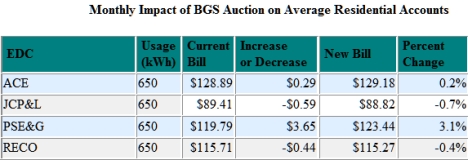

Rather, the following table illustrates how the auction results will affect electricity supply costs for the average residential customer when the new rates take effect on June 1, 2021:

For fixed price residential and small commercial customers (BGS-RSCP, below 500 kW), the 2021 BGS auction procured 36-month tranches for the period starting June 1, 2020, with pricing as follows:

Final fixed price BGS rates will reflect a blend of the above prices and prices from the two prior BGS auctions, under a blending process. The energy secured in the fixed-price auction will meet one-third of the state's residential and small business electric load requirements for the next three energy years, starting June 1, 2021. The remaining two-thirds of customer supply requirements for the 12-month time period beginning June 1, 2021 will be met by electric supply secured in the BGS auctions of 2019 and 2020.

The BPU also approved results from the CIEP auction (hourly priced customers)

The winning prices for the CIEP auction was as follows:

For CIEP customers, the prices for all EDCs are lower than last year’s prices. The CIEP price is primarily driven by the cost of electric generating capacity from PJM’s Reliability Pricing Model (RPM) Auction and the cost of meeting the State Renewable Portfolio Standard (RPS). Capacity prices for the 2021-2022 service year were up slightly for PSE&G but were slightly lower for ACE, JCP&L and RECO.

The 2021 winning bidders of the Residential and Small Commercial Pricing (RSCP) Auction are:

The 2021 BGS-CIEP Auction winners are:

ADVERTISEMENT Copyright 2010-21 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

February 11, 2021

Email This Story

Copyright 2010-21 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

2021 BGS-RSCP Auction Prices

36-Month Tranches

(One tranche = approximately 76 to 92 MW)

Utility Closing Price Tranches

(¢/kWh) Procured

ACE 6.420 7

JCP&L 6.477 20

PSE&G 6.480 29

RECO 6.692 1

CIEP Auction 2021 Prices

Utility Closing Price Tranches

($/Mw-day) Procured

ACE 339.20 4

JCP&L 295.88 11

PSE&G 351.06 24

RECO 368.93 1

Tranche sizes are approximate, as follows:

ACE – 80.45 MW

JCP&L – 76.74 MW

PSE&G – 75.46 MW

RECO – 54.69 MW

Axpo U.S. LLC

BP Energy Company

Calpine Energy Services L.P.

ConocoPhillips Company

CPV Shore LLC

DTE Energy Trading, Inc.

Exelon Generation Company, LLC

Hartree Partners, L.P.

NextEra Energy Marketing LLC

ConocoPhillips Company

DTE Energy Trading, Inc.

Exelon Generation Company, LLC

Hartree Partners, L.P.

NextEra Energy Marketing, LLC

TransAlta Energy Marketing (U.S.) Inc.

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Commercial Sales Support Representative -- Retail Supplier

• NEW! -- Channel Partner/Channel Sales Manager -- Houston

• NEW! -- Wholesale Originator -- Retail Supplier -- Houston

• NEW! -- Trading Analyst -- Retail Supplier

• NEW! -- Renewables Trader -- Retail Supplier

• NEW! -- Channel Partner Sales Manager -- Retail Supplier

• NEW! -- Experienced Retail Energy Account Manager

• NEW! -- Sales Channel Manager -- Retail Supplier

• NEW! -- Retail Energy Account Executive -- Texas

• Supply and Pricing Analyst -- Retail Supplier -- DFW

• IT Billing Project Manager

• IT Billing Business Analyst

|

|

|

|